Stock options are very different from RSUs. Although they both are a popular form of tech companies’ compensation structure, the thought process and planning couldn’t be more different. Maybe your employer just announced that future awards will now be RSUs and you haven’t even figured out how your old stock options work. Or maybe it is more complex and they are allowing you to pick which form of stock compensation you prefer. Either way, you likely have a big decision to make and it would be helpful to have a basic understanding of how both non-qualified stock options and RSUs work.

Incentive stock options (ISOs) are another type of animal, of which I have yet to establish a strategy guide. Stay tuned or sign up for future strategy guides to be the first to know!

Fast Travel Links

What are Non-Qualified Stock Options

Non-qualified stock options used to be the most common form of stock compensation, but in recent years many companies have begun to transition to RSUs. Non-qualified stock options typically vest over a period of time and have a strike price that you would pay in order to purchase the shares. Don’t worry though, most employers allow you to do a cashless exercise.

A cashless exercise allows you to purchase your shares without needing a chunk of money to use to pay for the shares. Instead, shares are immediately sold and the difference between the current price and the strike price you pay per stock are used to pay for the rest of your purchase. In doing this, you will end up retaining

We’ll review when you may exercise your shares, but it’s pretty safe to say here that you would never want to exercise your shares if the strike price is higher than the current value. If that was the case and you still wanted to purchase shares, you may look to do so through your Employee Stock Purchase Plan or directly through a brokerage account.

What are RSUs

Like I said, RSUs are taking over the tech stock compensation world. RSUs also commonly vest over a specified schedule. The strike price is basically zero and you have no control over when you become the owner of your employer shares. As shares vest with RSUs, you automatically receive the stock compensation.

When Do You Exercise

Non-Qualified Stock Options

With Non-Qualified Stock Options, you have a lot more control. You can exercise immediately when your shares vest. However, you can also wait all the way through your expiration date. If you’ve received multiple non-qualified stock options, you will have various vesting dates and various expiration dates to monitor. Make sure you keep track of these shares, one of my clients had actually misplaced close to $100,000 of non-qualified stock options and there was only three years remaining before these shares expired! Needless to say, I easily covered my costs in helping them locate and develop a strategy for these rediscovered shares.

RSUs

With RSUs, exercising isn’t an option and you become the owner as shares vest. When you sell and navigating your tax obligation becomes the focal point of establishing a clear strategy.

How Are You Taxed?

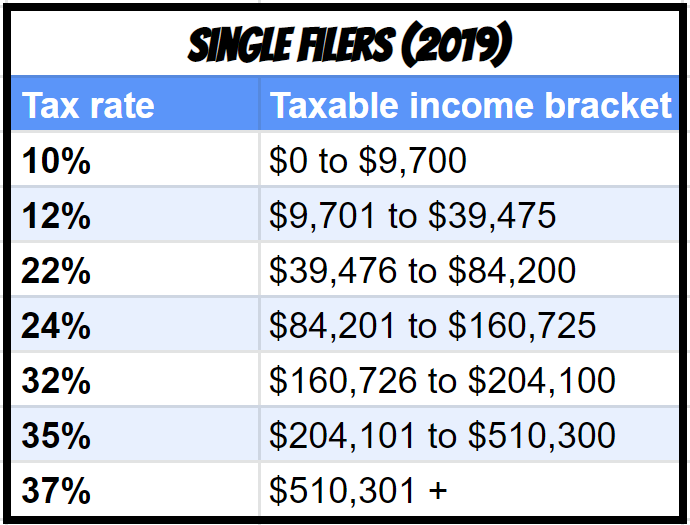

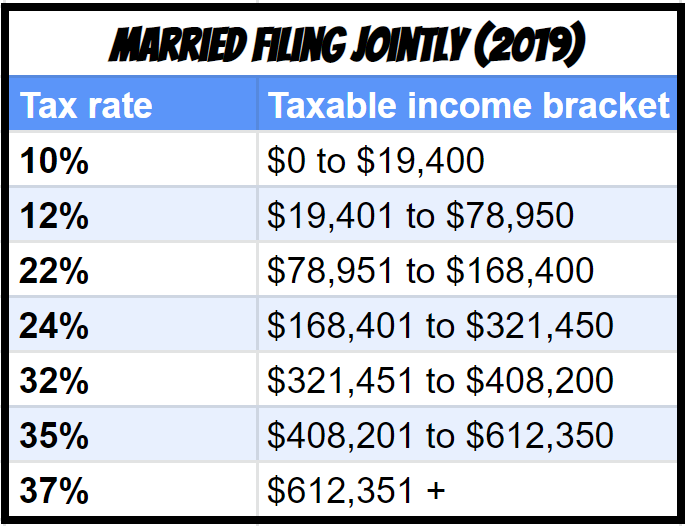

How you are taxed between non-qualified stock options and RSUs is also a meaningful difference. Both taxable portions of non-qualified stock options and RSUs are taxed as ordinary income. That means they are subject to Federal, State, Social Security, and Medicare taxes.

Non-Qualified Stock Options

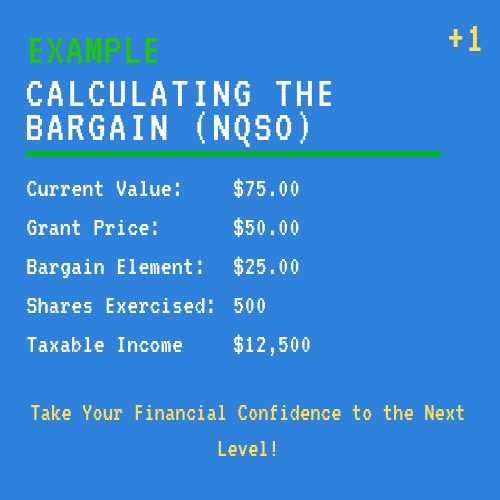

Non-qualified stock options are only taxed when exercised. This means you can control when you will recognize a taxable event, which allows for many strategies that I will highlight a little later. When you exercise, you will be taxed on the bargain element, which is the difference between the current value and the strike price of your options. This is multiplied by the amount of shares exercised.

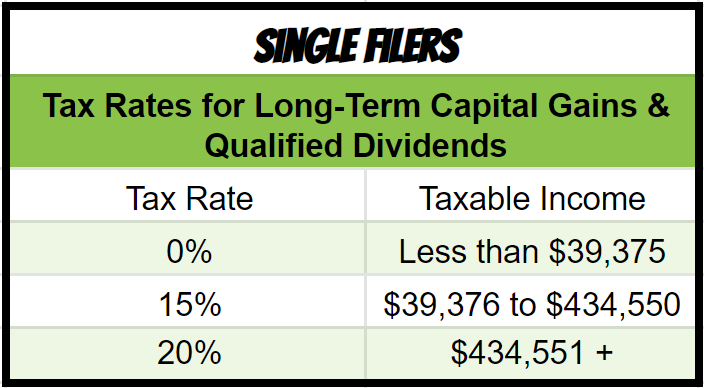

After you own your shares, future gains and losses will be taxed as capital gains. Holding longer than one year will provide preferential tax treatment under long-term capital gains tax rates.

RSUs

Unfortunately, you can’t control when RSUs produce a taxable situation since you instantly receive your stock compensation when they vest. The taxable income can be calculated by multiplying the shares that vested by the value of the shares at the time of vesting.

Similar to non-qualified stock options, after you own your shares, future gains and losses will be taxed as capital gains. Holding longer than one-year will provide preferential tax treatment under long-term capital gains tax rates.

Terminated

There is a reason stock compensation are called golden handcuffs. It’s hard to actively walk away from piles of unvested shares of stock and even then the likely possibility that you’d continue to earn these types of compensation awards. Here is what you need to know about non-qualified stock options and RSUs if your employment terminates.

Non-Qualified Stock Options

This is truly one of the benefits of having Non-Qualified Stock Options. You usually are allowed a period of time, though relatively short 30-90 days. In some rare scenarios I have heard it being an even greater window. You’ll want to review your award letter to determine the length of time you have to exercise shares after your employment is terminated.

RSUs

Unfortunately, RSUs go “poof”. However, I have been witness to a few scenarios where the RSU vesting schedule is accelerated and you actually receive unvested shares. The two scenarios I have seen this occur is with a “

Strategies

This is where I have a lot of fun. Building a strategy that aligns with your life, goals, and increases your financial confidence is what I take pride in accomplishing. Remember with non-qualified stock options, there are two parts of the strategy: when to exercise and when to sell

Non-Qualified Stock Options

Low Expectations for Company:

Exercise and Sell: When your shares hit a minimum acceptable value. Be aware that the price may never be reached and worse it could fall below your strike price making your options worthless. Under this scenario, you exercise and sell as close to each other as possible since you don’t feel positive about the company’s future growth.

High Expectations for Company (Two Strategies):

Exercise Early and Hold Long-Term: Exercising early and holding long-term would yield the lowest taxes IF the stock price increases as it approaches the expiration date. That is because the bargain element is substantially lower in this hypothetical and the bargain element is treated at higher ordinary income tax rates. Holding long-term would qualify the gains to be treated at more favorable long-term capital gains rates.

Wait Until Near Expiration, Exercise, and Hold: Waiting until near expiration before exercising would defer taxes into the future, but would produce a larger tax bill because the bargain element would apply to all of the growth that occurred during this hypothetical scenario.

Average Expectations for Company:

Exercise and Sell: Having ho-hum expectations for how your stock options may perform is not very inspiring. The reason why this strategy may make sense is because average expectations may fall in the same categorization return wise as the diversified stock market. If you expect the same return, the risk with an investment in the diversified stock market should be less.

RSUs

The strategies are similar to the non-qualified stock option counterpart with the already discussed tax impact differences and the fact that you do not have control over exercising.

Low Expectations for Company:

Sell Immediately at Vesting: This locks in the value of your shares and does not give them the opportunity to fall in price. Selling almost immediately at vesting leads to a negligible tax event since you already have to pay taxes when the shares vest.

High Expectations for Company:

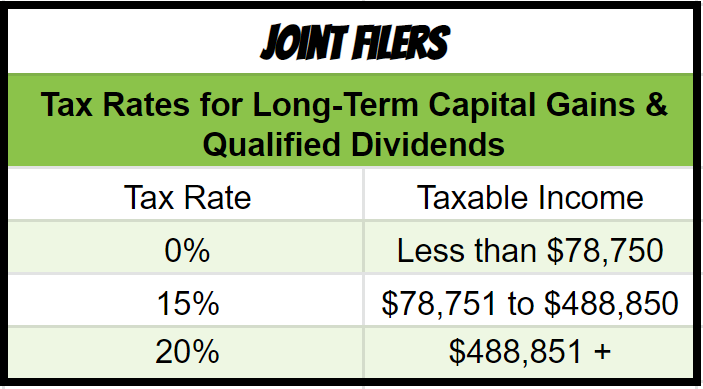

Hold Long-Term: Holding your vested RSUs long-term will allow any additional growth to qualify for long-term capital gains tax rates.

Average Expectations for Company:

Sell Immediately at Vesting: This is identical to the explanation provided under the non-qualified stock options strategy for average expectations. Why take on the additional risk of a single company stock, when you can receive similar expected returns from a diversified investment?

How Much Employer Stock Should I Own?

Maybe you are pretty confident in your employer’s shares, but are starting to accumulate it at warp speed. That happens pretty regularly, as shares just continue to be awarded and if the value of shares you’ve already earned continue to grow in value.

Non-Diversified

A common argument against holding a substantial amount of your wealth in employer stock is the ancient saying “don’t keep all of your eggs in one basket”. The risk is further amplified by you being employed by the company, which gives you even more exposure. What happens if your company runs into trouble and in addition to the shares dropping and they lay you off along with 100’s of your colleagues? That’s a double whammy!

Rule of Thumb

The rule of thumb for holding employer stock is 10% of your liquid assets. This number may be extremely low for young professionals who simply haven’t had the time to build other asset types.

This also ignores your risk tolerance, which I think shouldn’t be ignored. You need to be really comfortable with the possibility that your company may drop like a rock.

What About My Capital Gains?

A common argument for holding employer shares longer than you may even prefer is the fear of the tax impact. Remember, shares held greater than one year are taxed at the substantially more favorable long-term capital gains rates. Another cool thing you can do is target specific shares, which allows you to choose shares that may have lower pent up capital gains.

There are also a few additional things you may want to consider:

Charitable Donations

You can gift shares directly to qualified charities and potentially receive tax deductions if you itemize your deductions. The charities are then allowed to sell your donated shares tax free.

Should I Use a Donor Advised Fund Strategy Guide

Family Gifting

This works well when you are gifting to a young adult or lower income household. That is because the long-term capital gains tax only kicks in after income exceeds a certain threshold ($39,375 Single; $78,750 Married Filing Joint).

Tax Rate Arbitrage

This is my favorite strategy to use, and it’s probably because I never hear of anyone else talking about it. You may have access to a few different special tax treatment accounts. Traditional 401(k), IRA, Health Savings Accounts. If you contribute to these account types you will save taxes at your ordinary income rate, which for many of my clients tends to be drastically higher than their capital gains tax rate. Making additional contributions into these accounts can help offset and maybe even save you on your tax returns.

I Prefer RSUs for Most Clients

There are definitely pros and cons for both non-qualified stock options and RSUs. However, RSUs are drastically simplified by removing the choice of having to choose when to exercise your shares. They also will always have a value when they vest, which is something stock options can not state.

To hedge a little bit, non-qualified stock options offer some unique tax control and additional strategies, but I feel this flexibility really only provides value to an expert. To everyone else it’s just an additional thing to stress out about and potentially mismanage.

Stock compensation can be very lucrative, but remember to not get greedy. Just as fast as a meteoric rise, a company can crash spectacularly without any warning.

- Why Your Paycheck May Be Smaller This Month

- Decoding Bonuses and Raises: What’s the Real Value of Your Bonus, Raise, and RSUs?

- #1 Reason Techies Struggle Financially: Credit Cards!

- Navigating the New Tech Job Market with Sean Page

- Breaking Out Of Tech

Additional Resources for Stock Options Vs. RSUs

https://finance.yahoo.com/news/important-differences-between-restricted-stock-085000384.html