How should you and your spouse split your finances? Financial issues are one of the leading causes of divorce, so it is important to start out strong. Unfortunately, there is not a magic bullet. It does not make sense that there would be only one way to approach finances as a married couple. Instead, I will provide you various scenarios and examples that you may wish to model for your family.

Do you know you and your spouse’s wealth-building potential? Take our free assessment.

Fast Travel Links

Married Couples Money Conversations

It is so important that you communicate with your spouse about your finances. If this is not an area that you have worked on in the past, this alone will pay dividends if you begin to have these discussions. Early on the discussions may be awkward and stressful, but over the years, this could actually be a core strength in your relationship.

How to Have Awesome Money Conversations Video

Same Side

Going into the first few money conversations as a married couple may feel like you are going into battle. You may tense up because of your financial weakness or target weaknesses of your spouse to defend yourself. I know this is easier said than done, but DON’T DO THAT!

Your first money conversations should not be a chess match. Instead, remember that you are on the same team. You made the commitment to go into battle together.

Goals

Having common goals pulls people together. That is true for marriages, as well. I actually do not talk about saving, spending, or investments without first getting crystal clear on my clients’ goals. I encourage you to take that same process. Start with your “why”. Starting here will give you inspiration and empower you to take on the challenges of building a strong financial foundation together.

History

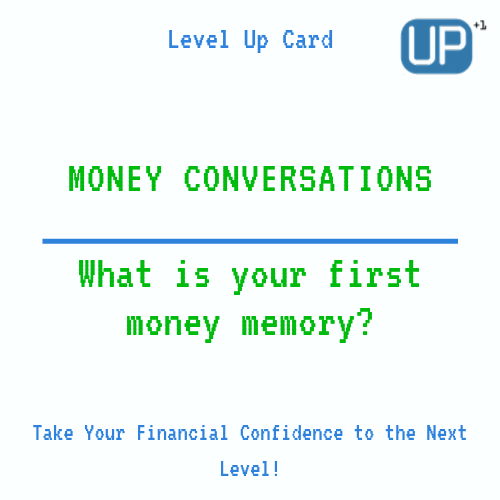

It may also be very helpful to understand each other’s background with money, too. I consider people’s financial experiences and behaviors to be as unique as snowflakes. Questions you may want to ask each other are:

- What is your first money memory?

- How did your parents handle money?

- What was the best financial decision you ever made?

- What was the worst financial decision you ever made?

- The follow up to all of these is Why?

Have fun and learn more about each other. The answers may actually help you identify why your spouse is so “weird” with money. P.S. They probably think you are the weird one.

Check out How to Choose Your Beneficiaries Strategy Guide

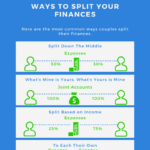

Married Couples Combining Everything

This is the most common way that couples approach their finances. Although it doesn’t make it the right way, it does make it really simple. The married couple combines everything: income, accounts, investments, and debt.

Even when my clients have this style for managing their finances, I do encourage them to each have a separate checking account with a designated amount for them each month. You can call it “funny money”. That is where gifts for each other, as well as, personal extras are spent without the guilt of wasting your spouse’s money.

Your “funny money” amount will vary based on your goals, income, debts, and savings. Basically it’s what is safely left over after you do everything else that is “highly important”.

Married Couples Splitting Finances Based on Income

How your income is generated as a married couple, definitely could impact how your split finances. Your household situation may even shift from one description and strategy to others through the course of your careers. My wife and I actually would have touched each of the following examples, although we began combining our finances completely once we were engaged.

Equal Income Earners

If you both are earning fairly equal incomes. It could make sense to split the joint cost rent/mortgage and utilities equally where they are paid through a joint account. The remaining expenses like vehicles, cell phones, and all of the extras would be paid by yourselves out of your personal accounts or credit cards. This may actually be the easiest approach even over combining everything. However, it is very rare for both spouses to earn pretty identical incomes consistently throughout their careers unless they are in the same fields with similar responsibilities.

High Income/ Low Income

This is where it starts to get a little tricky. Should the higher earner pay for everything the lower earner wants? If you’ve made the decision to not combine your finances completely, there may be a reason for that. So if you do have a significant reason for this, I think the biggest thing to distinguish between

However you decide to approach it, you want to be consistent. If you start out supporting your spouse’s exorbitant lifestyle, they may get used to that lifestyle. Trying to reverse course later may lead to a more stressful conversation.

Stay at Home Spouse

Under the assumption that one spouse is staying home as a part of a joint decision or for medically related reasons, I think support should go beyond “needs”. It may make sense to combine finances equally in this scenario, but even if you decide not to fully commit to that approach, some “wants” should also be supported if you are making similar purchases.

Similar purchases may vary widely since people value different items. My wife likes Yankee Candles and I like watching PPV Boxing. Over the course of a year, those expenses are practically identical.

Married Couples Splitting Finances Based on Savings

I mentioned savings and goals a few times already, but regardless of how you decide to split the income and expenses part of the equation, you cannot forget savings!

Emergency Savings

Do you have no idea how much to save for emergencies? Here is a rule of thumb that I use with my clients as a starting point. Three months of monthly expenses if both are earning similar incomes. If one spouse has a significantly greater income, you may need closer to six months of monthly expenses. Again, this is just a starting point, you will want to assess other unique circumstances that may impact your savings needs.

Retirement Savings

Is retirement not even on your radar? It’s actually really important to start early. If you start early, you can use the time and compound returns to make your financial life so much easier.

Imagine living in retirement without a traditional paycheck for 25-30 years. Where are those funds going to come from? The amount you should save varies based on your unique circumstances and goals. A minimal goal to strive for would be the double-digit percentage of your income.

You especially want to make sure that you are doing enough to at least get “free money”. “Free money” is the contribution that your employer may make into your retirement account through an employer match.

Not all retirement plans are created equal. One spouse’s retirement account may have better investment options, a higher employer matching percentage, or lower costs. Aim to get the full employer match for each of your retirement plans, but any excess contributions you may want to be more strategic.

Like Podcasts? Listen to: What the Tech is a 401(k)

Short-Term Goals Savings

Short-term goals, I argue are almost just as important as long-term goals. I consider short-term goals to be within the next one to three years. A few examples of short-term goals my clients have are: travel, purchase a home, remodel, start a family, start a business, etc.. These goals are exciting and feel more real than long-term goals like retirement. Succeeding in these goals can help you increase your financial confidence. The amount you need to save is very specific to your goals and timelines, but they are fairly easy to calculate. The trick is balancing these with the more fuzzy, but still important goals like retirement savings.

Some spouses sometimes split their savings for these goals. Example: Your spouse may be more excited about travel, so they can choose to save for travel. You might be more excited about purchasing a home so maybe you focus on saving for the down payment. You both are making progress, but are focussing your savings based on what excites you most about your goals.

Married Couples Splitting Finances Based on Debt

Debt is an interesting aspect of potentially splitting your finances. I believe it is highly important that regardless of how you split your finances, you want to be sure that you are both handling your debt load responsibly.

Past Debt

Determine how you want to approach the past debt that either of you may have. Even if you are not assisting with these old debts, it’s helpful to know what your spouse has on their plate because it may impact their ability to help with other expenses.

Spending Issues

If you keep your finances completely separate and one or both of you are building up debt without the other being aware, that could be a potential bomb to your relationship. Knowing this earlier in your relationship will allow you both to come up with a game plan of how to live below your means.

Credit Scores

Credit scores are actually like report cards for how you manage your debt. Although credit scores are an individual based score, past credit issues could come back to haunt your marriage. Especially where it concerns joint assets that may not even be tied to debt.

Married Couples Splitting Financial Responsibilities

Regardless of how you may split the actual financial numbers, I encourage you to split financial responsibilities. It is really crazy how many different financial transactions occur each monthly for married couples.

- Monitoring Your Family’s Plan (more important than investments)

- Balancing Budget

- Grocery Shopping (helps reduce the cost of eating out)

- Cooking (helps reduce the cost of eating out)

- Investments

There are really two different ways you may want to analyze how to share the responsibilities: interest and time.

Interest

Sometimes it may be easy to break up some financial responsibilities by what you each enjoy. One of my recent podcast guests, Kathy Haselmaier, shared this example: her husband enjoys handling the investments and Kathy keeps track of balancing their bank accounts.

Time

Sometimes out of necessity, things still have to get done so someone needs to step up. Allocating different task responsibilities based on which of you have the time to squeeze in these tasks. If you haven’t already, automate everything that you can.

Have no interest or time? I can help you create a strategy guide.

Married Couples and Inheritances

This may not apply to everyone, but I recently wrote a strategy guide on How to Manage Your Inheritance and there are a few reasons to support separating your inheritance from your spouse. If you plan to keep your finances separate than this probably is not even an issue. However, if you lean more towards combining your finances you may want to think twice when it comes to inherited assets.

Lawsuits

Keeping the account in the inheritor spouse’s name only may help prevent it from being included in lawsuits from creditors. You will want to make sure that the inheritance never transfers into a joint account. Even if correcting immediately, the courts may have recourse to include the inheritance.

Divorce

Obviously, no one gets married expecting divorce to occur, but it happens. Here is some info to make sure you are aware of the consequences of commingling your inheritance with your spouse. If the inheritor spouse keeps the inheritance funds completely separate, then it is not included as joint assets. As soon as you begin to purchase things, like a new home. That home may be subject to the divorce process and be included as joint assets to be split.

How Will You Split Your Marriage’s Finances?

As you can see, you can slice and dice your finances in many different ways. That’s one of the reasons why I love helping clients work through their financial life. Even if you keep things completely separate, I hope you identified how important it is to talk to each other and be a team. At the end of the day, it comes down to where your relationship and ability to achieve your goals is strongest. I have seen ultra-successful married couples who combined their finances and built a lot of wealth and are extremely happy. I have also seen married couples who love each other and their lives, but have everything completely separate and are just as wealthy.

Married Couples Finance Game

Welcome to Level Up’s Married Couples Finances Game. My goal in creating this game is for you and your significant other to ask non-threatening questions that you likely have never discussed before. The answers to these questions may provide a lot of insight into why you are so different or possibly so similar when it comes to your money habits.

Married Couples Finance Game Rules

- Remember you are both on the same team.

- When you ask the question, listen without judgment.

- You don’t have to ask all of these questions in one sitting.

- Have fun!

Married Couples Finance Game Takeaways

- Get used to discussing finances as a couple.

- Learn more about each other.

- Identify goals so you can begin to prioritize.

- Identify similarities and differences in each other’s financial mindset.

Connect with Level Up Financial Planning on any of our social platforms: LinkedIn Facebook Twitter

Lucas Casarez is a Certified Financial Planner™ Professional serving tech professionals virtually out of Fort Collins, CO