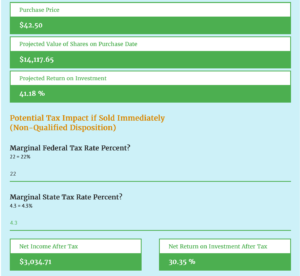

Use the calculator to estimate your potentially guaranteed return rate on your employer stock purchase plan (ESPP). The only way to lock in the return is to try and sell the shares as soon as they are purchased. This will result in taxes being recognized in the year of the sale, which you can also project in the calculator below.

If you need a reminder on the basics of how your employer stock purchase plan (ESPP) works visit my full strategy guide or check out the ESPP Cheat Sheet below.

The calculator is very intuitive and you should be able to quickly estimate potential returns and tax impacts of your employer’s ESPP.

Employee stock purchase plan (ESPP) Calculator Example Video

Info needed to use the estimator:

- Employer Contribution Limit

- Employer Discount Percentage

- Discount Method

- End of Purchase Period Price (Most Common)

- Lower of Beginning or Ending Purchase Period Price (Most lucrative)

- End of Purchase Price is unknown and must be a hypothetical value of your choice

- *Optional* Marginal Tax Rates (Federal & State)

Please wait a few seconds for the calculator to load below.

Are you a tech employee in your 20’s or 30’s? I created a new podcast just for you. Techie Personal Finance Bootcamp