Are you afraid of the big bad gift tax? Although you can pay the gift tax if you want to, the good news is that you do not need to. There are a couple of different ways you can gift to your loved ones and avoid paying any taxes. Sound good?

I’m writing this strategy guide because it is common for non-tax experts providing tax advice and when it comes to gifting, there is the common misconception that someone will need to pay the tax.

The truth is there are quite a few ways to avoid paying the gift tax. You will still want to keep an eye out for taxable sales, but outright gifts should be tax-free.

Fast Travel Links

Gift Tax Annual Exclusion

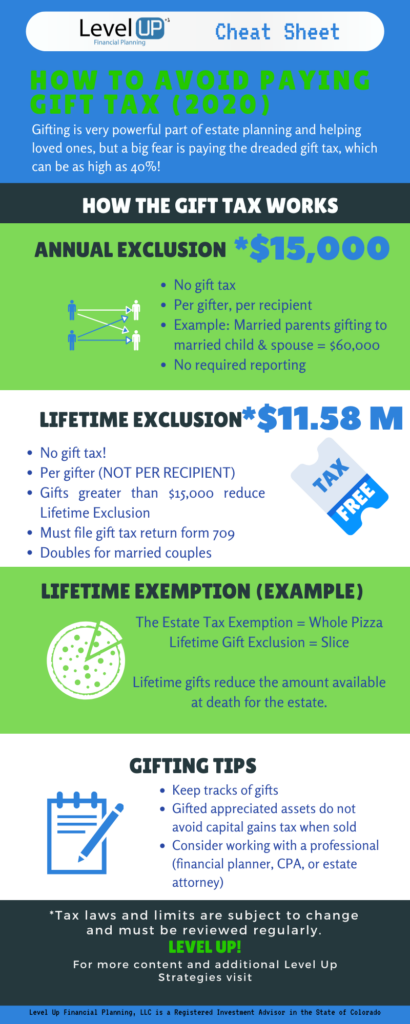

The easiest way to gift and avoid paying the gift tax is to stay within the annual exclusion limit of $15,000 (2020 limit). If you do, then you do not need to report it, which eliminates the hassle of including it with your tax reporting when you file your personal tax return.

The $15,000 is per gifter, but also per recipient.

Want to gift more than $15,000? Here are a few ways to do that without having the excess amount count against your Lifetime Exclusion.

- Are You Married? Your spouse can also gift $15,000.

- Is The Recipient Married? You can gift to the recipients’ spouse $15,000.

- Near The End Of The Year? Gift before the end of the year and the annual exclusion resets January 1st!

If all of the above strategies can be used, that’s up to $120,000 while avoiding it counting against your Lifetime Exclusion.

Gift Tax Lifetime Exclusion

Not able to utilize all of the strategies mentioned for the Annual Exclusion? No problem, you can gift up to $11,580,000!

It’s safe to say you’re probably not going to ever have to pay the Gift Tax.

The Lifetime Exclusion is dramatically different than the Annual Exclusion. Here are some of the different aspects to be aware of:

- Per gifter. Not per recipient.

- Does not reset annually, but may change due to tax-law.

- CAN BE USED for gifts that exceed the Annual Exclusion.

- You can choose to pay taxes if you wanted (I never met anyone who has chosen to pay taxes that could be legally avoided.)

- Must file a gift tax return form 709

- Married? The Lifetime Exclusion doubles.

- Any Lifetime Exclusion that is unused carries over at death to your Estate Tax Exemption

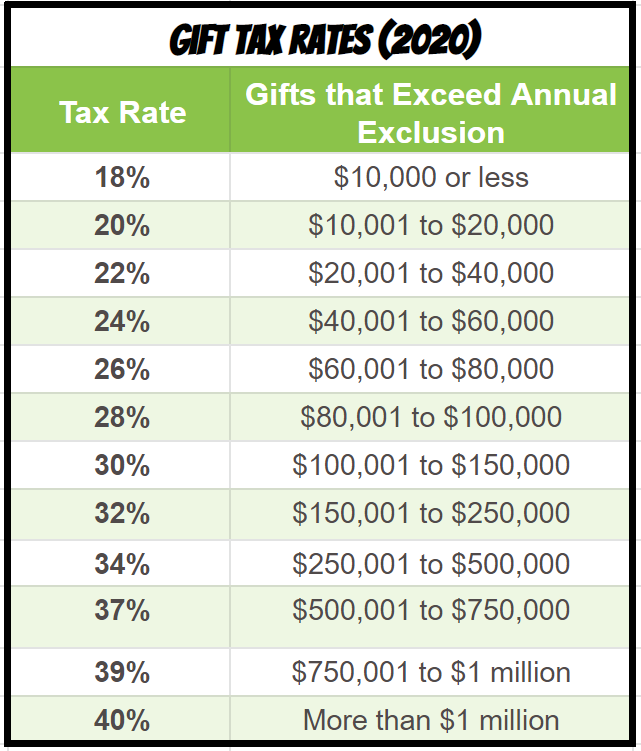

Gift Tax Rates

Here are the gift tax rates just in case you wanted to know what the tax rates would be if you chose not to use your Lifetime Exclusion.

Non-Gift Taxes May Apply

When you gift assets and not cash or check, then it is possible the recipient may need to pay taxes when they sell the asset. In most cases, your cost basis will be their cost basis. This means that appreciated assets may cause capital gains taxes to your recipient when they sell.

Occasionally this is an effective way to reduce taxes if you are in a higher income bracket then the recipient, but you want to make sure you have a plan so no one is surprised.

Keep in mind that your beneficiaries will receive a step-up in cost-basis on non-retirement assets and property at your death. For this reason, it may be most tax-efficient to avoid gifting highly appreciated assets that can be held until you pass. Weird subject I know, but this can literally save thousands of dollars in taxes.

The Gift Tax is Avoidable

After reading his strategy guide, I hope it’s clear that there is really no reason to pay the gift tax or even have to worry about it. You will want to plan and strategize the most optimal way to structure your gifting.

Please reach out if I can help you build a comprehensive plan or with your tax-strategy through my partner tax firm, Power Up Tax Planning Services, LLC.

Lucas Casarez is a Certified Financial Planner™ Professional serving tech professionals virtually out of Fort Collins, CO