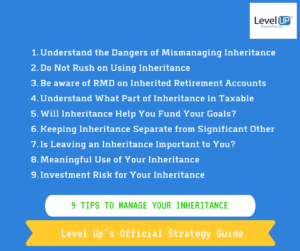

This strategy guide on how you manage your inheritance

Fast Travel Links

1. Understand the Dangers of Mismanaging Inheritance

The biggest fear that you may have is that you will waste it. This happens a lot more than you could imagine. Instead of treating the inheritance with respect and as a valuable asset, many treat it as lottery winnings. This happens because the large dollar amount seems like it affords you more than it really does.

Spend It All

When you receive a windfall, it’s very common to assume that it is more money than you could ever spend, but in reality, things can add up quickly. Or when it comes to spending, subtract from your inheritance quickly. There may be a good reason to spend all of your inheritance. I have a few tips below that will help you hone in on good reasons. The biggest reason why you may not want to spend it all is that your inheritance could be a huge resource for you to improve your financial life. If you’re able to invest your inheritance, then it may start to grow into an even larger amount.

Blank Check Mentality

The ones that fall into the lottery winner syndrome, feel like they have so much money there is no way they can possibly spend it all. They no longer look at the price tags and are probably looking to upgrade some major lifestyle materials: a new car, new house, everything decked out. This isn’t a phenomenon that only applies to lottery winners and inheritors of considerable wealth, but professional athletes and movie stars, too.

Jump the Gun on Retirement

Early retirement can be very attractive, but is it a reality? This mistake is one that is better illustrated through an example:

*Example- Let’s say you inherited $200,000. That seems like a lot of money. Early retirement may even cross your mind for a second. However, $200,000 that generates an average return for a diversified portfolio typically has a safe withdrawal rate of 4% per year or $8,000.

Using a greater amount than $8,000/year would put your investment at risk of being depleted. You would likely need a lot more than $8,000/year to survive.

Permanently Increase Lifestyle

The most dangerous outcome could be that you lean on your inheritance to support your lifestyle at an unsustainable rate. This happens when you increase your spending habits above what your normal income could afford. Once your inheritance is depleted, if you keep at your current spending pace, which most people do, then you will start to rely on credit cards and other forms of debt that cripple future possibilities for you and your family

Check out The Downside to Making the Most Money You Ever Have

2. Do Not Rush on Using Inheritance

Other than requirements for processing the inheritance into your ownership, you should avoid the urge to act. A common emotional reaction to experiencing a loss is to try and take control. Give yourself time to grieve and not worry about the money aspects. Yes, you can keep reading for educational purposes, but fight the urge to start making bold maneuvers with your inheritance if there isn’t a real urgency to do so.

3. Be Aware of Withdrawal Requirements on Inherited Retirement Accounts

If you are the spouse, then you can absorb the retirement account into your own name.

Most other beneficiaries will have unique withdrawal requirements. In the past these withdrawals were called Require Minimum Distributions, which would have required a small portion of the account to be withdrawn each year and could be stretched over your life time.

However, in 2019 the SECURE Act was passed, which simplified withdrawal rules. Now most beneficiaries are required to withdraw the whole inherited retirement account within 10 years. You can make withdrawals however you like over the 10 -year period.

Withdrawals from a Traditional IRA or beneficiary IRA is a taxable event, which means it will increase your taxable income for the year withdrawn.

Inherited ROTH accounts will have no tax impact as you make withdrawals since ROTH accounts are funded with after tax contributions.

4. Understand What Part of Inheritance is Taxable?

This is another huge concern for clients when they reach out for assistance. Many inheritances have a multitude of types of assets that are inherited and each may have its own unique tax treatment. This is easily the most complicated part of handling your inheritance, so I will provide a significant amount of details for this part of the strategy guide.

Did you hear the exciting news? Power Up Tax Planning Services has officially launched and has a few spots remaining for the upcoming tax season.

Life Insurance

When you are the beneficiary of a life insurance policy, there is no tax impact on the life insurance proceeds you receive. This is one of the unique benefits that life insurance offers to surviving beneficiaries.

An example of the impact of a tax-free life insurance payout of $100,000 compared to an income of $100,000. I used SmartAsset’s tax calculator (sorry they are still stuck in 2018) to estimate the tax hit for an individual earning $100,000 with no deductions or adjustments other than their standard deduction.

The net income received comes to $72,311, which is $27.690 in taxes. So tax-free is a big deal!

Step-Up in Basis (you were not an owner on the inherited asset)

- Bank Accounts

- Property

- Non-Retirement Investment Holdings

A step-up in basis is when you are able to increase the cost basis up to the market value of an asset. This leads to potentially large tax savings to inheritors of these types of assets, which you will see listed below. Step-ups in basis is also is one of the most overlooked strategies to review when individuals and families receive inheritances.

I actually once caught a tax savings of about $80,000 due to a step-up in basis. Even more, interestingly, his own CPA, which is a dedicated tax professional missed these tax savings!

When you receive the assets mentioned below, you want to take note of the market value of them so that when you go to sell at some point down the road you are only taxed on the growth in value since the date of death. If you sell these assets relatively soon after you inherit them, then you may not actually have any tax consequences. Something that is helpful if you inherited a home on the other side of the country or logistically it doesn’t make sense for you to keep.

No Step-Up, Always Taxable

- 401(k)s

- IRAs

- ROTHs (step-up is not needed, as ROTHs are inherently tax-free)

- Qualified Annuities

- Non-Qualified Annuities (the original principal investment is the cost basis and any growth is considered taxable income as withdrawn)

5. Will Inheritance Help You Fund Your Goals?

There are countless ways you may choose to use or spend your inheritance. If you already have clearly defined goals, it may be worth it to look into the feasibility of using your inheritance your probability of fulfilling goals that you had already determined at a faster rate.

Is one of your goals to pay off debt? That is a popular choice for using one’s inheritance, but I think it does make sense to review ALL of your goals before committing funds to pay off debt. Especially, if the interest rates are really low. Credit card debt is something critical to address, but your spending habits also need to be checked before you get too excited about spending your inheritance.

If the inheritance is sizable enough, it may actually allow you to pursue goals that previously you may have thought were never attainable due to whatever constraints you envisioned as being obstacles. Also, consider the previously mentioned ways people mismanage their inheritances. You will want to make sure that your plan is realistic when making bold changes to your goals.

6. Keeping Inheritance Separate from Significant Other

This is a tricky part of navigating your inheritance. Remember, it is always your decision about how you use your funds. The reason why this is important to get clear early on is that your inheritance is legally protected if you keep it separate. The second you commingle assets, they become fair game for your significant other’s creditors, lawsuits, and factored into divorce settlements.

With that said most of my married clients consider their assets to be the couple’s assets, but still keep the inherited assets uniquely separate, which is good for Tip #7.

When I get a little scared, and luckily I haven’t had to deal with this scenario, is when the significant other is a boyfriend or girlfriend. Not yet committed enough to be a spouse. The question in Facebook groups and Reddit posts look like this: “I recently inherited money and I am considering paying off my boyfriend/girlfriend’s student loan debt. It is roughly $50,000. Is this something I should be considering? Also, they have been notorious for mismanaging money, have horrible credit, and an old bankruptcy.” I’m not lying, I have literally seen pretty similar wording multiple times.

Honestly though, if you see yourself in a less crazy scenario, here is what I would say. “Hey I wrote a strategy guide on this you should check out, but also, there are many ways you could help someone out without fully committing a large portion of your inheritance. You could just help with the monthly payments until they are able to handle it themselves or just take overpaying for groceries instead of splitting them. Once you actually get married that is a larger commitment and then the argument may start to shift more towards helping out. In lieu of that, the risk is too great and there is no way to recuperate if you pay for a sizable amount of their debt and then the relationship disintegrates. Even marriages have about a 50% divorce rate, dating percentages are significantly worse.”

7. Is Leaving an Inheritance Important to You?

You may have already been ahead of the game financially before your inheritance and receiving additional funds may not add significant value to your life in this circumstance. However, there are countless ways you can make an impact in someone else’s life. You may have children, grandchildren, nieces/nephews, or maybe a charity, church, or alma mater.

It doesn’t even necessarily have to be the traditional form of inheritance. Some wealthy families prefer to share their children’s and grandchildren’s “inheritance” while they are still around to see the benefits. Gifting to charities while you are alive may also be a tax-effective strategy to consider if you are charitably inclined.

Check out How to Choose Your Beneficiaries Strategy Guide

8. Meaningful Use of Your Inheritance

I always encourage my clients to reserve their inheritance for meaningful expenses. Setting this requirement for yourself will help you easily avoid miscellaneous expenses that you will not be able to recall a few years from now. How sad would it be to have used your inheritance, but not be able to definitively recall what those funds were used for?

If you decide to take this route, keep the inherited assets separate from your normal assets. This helps you to easily see what is your normal assets and which are inherited assets. I know many of my clients that like saying, “my mom helped pay for this wedding, or my dad helped pay for my children and grandchildren to go to Disney”.

9. Investment Risk for Your Inheritance

How much risk you take with your inheritance that is invested is a very important matter to be aware of. There are three measurements that I use to help my clients measure the amount of risk to take in all of their investments, including their inherited assets.

Time Horizon

Any portion of your inheritance that is meant to be used for short-term goals should not be invested at all. Once you have a window of 3+ years, then you start to allow yourself time to think about investing your inheritance. The longer the window of time, the more aggressive you may want to be. As you approach that goal time frame, you may consider reducing your risk.

Need

The potential return you may receive from your investments is the primary reason people invest. That return can vary greatly, but it is helpful first to understand what magic number or return you need to achieve your awesome goals. If you do not need a high return, then you may choose to not take excessive risk. If you do need a high return, that would be good to know now so that you have the opportunity to reach your goals.

Risk Tolerance

In addition to your time horizon, it is also crucial to know what you can stomach in terms of risk. It doesn’t matter necessarily when things are going well because those are good times. It matters when the shoe drops and poor performance and losses start to appear on your statements. If you panic and make a knee jerk reaction out of fear, you can easily erase and even permanently damage the value of your inheritance.

Sincerely

I hope all of these tips provide value to you as you attempt to navigate the emotional time period of losing a loved one. You have my sincere condolences. I have confidence that the fact that you took the time to read through this strategy guide, means you will be thoughtful with how you approach the management of your inheritance. Please reach out if you feel you need additional guidance and even if I’m not the one to help, I can assist with finding you someone that can.

Connect with Level Up Financial Planning on any of our social platforms: LinkedIn Facebook Twitter

Lucas Casarez is a Certified Financial Planner™ Professional serving tech professionals virtually out of Fort Collins, CO