RSU’s or Restricted Stock Units are a common part of tech employees compensation packages. I have helped many clients and their spouses understand how to utilize their RSU benefits to their advantage with planning. Retirement accounts and manageable investments receive much of the attention from other financial planners. In this post, I want to focus on providing you

Podcast Episode/Video Option De<Coding> RSUs (Restricted Stock Units)

Fast Travel Links

How RSU’s work:

- Grant Date: The date you were awarded RSUs

- Vesting Schedule: The rate and timing that you RSUs will be vested

- Vested: When shares vest, you become the owner of the equivalent of units that vested.

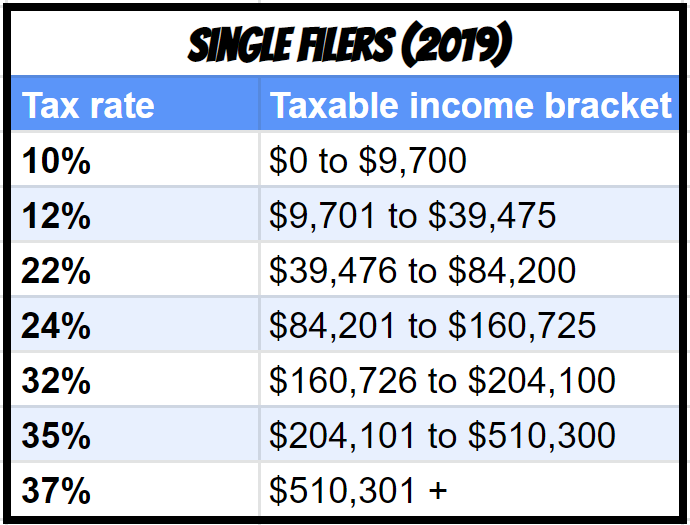

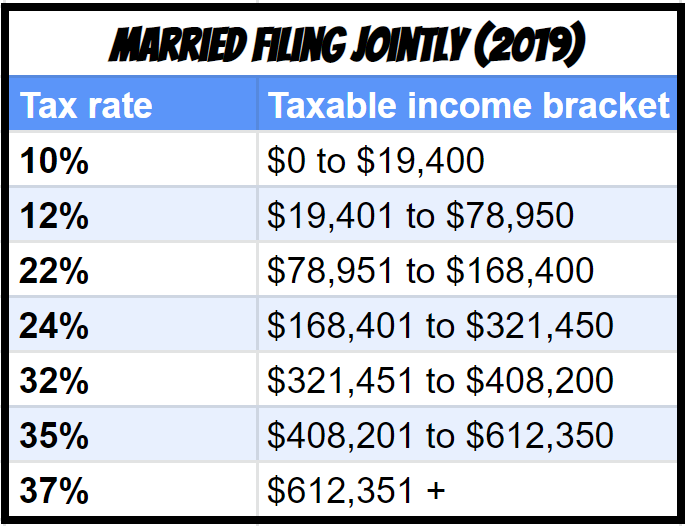

- How Taxes Work: You are taxed at the time your RSUs are vested at ordinary income tax rates. If you hold onto the shares, future growth or loss will be treated as Capital Gains/Losses. (Brackets provided later in the guide)

- Termination: At termination, you lose unvested RSUs unless your vesting schedule is accelerated at termination (common with workforce reduction packages).

Stock compensation can be very valuable to employees and the employer. Having an owners’ interest in the company you work for can increase productivity and job satisfaction. Stock compensation is also a built-in investment plan for employees. This allows them to realize the potential of having assets that work for you.

Have Non-Qualified Stock Options? See how they compare to your RSUs.

RSUs Risk

One threat that most employees often ignore is the real possibility that the stock may go down. A company’s stock can go down for many reasons, but here are just a few:

- a general market decline

- loss of competitive advantage

- product recalls

- products fading from relevancy.

This threat starts out small enough when you are new to the company. However, over multiple years it is really easy to build up a significant amount of your employer stock. That is a lot of non-diversified risk! What if you woke up the next day and because __________ (fill in the blank), the stock dropped like a rock and is now only 25% of the value it was the previous day. Hopefully, this is just a dramatization of what can happen, but think about it, how sick would you feel?

I always explain to my clients, “we have a plan that does not require us to hit home runs”. The key is to stick to plan and not allow the fear of missing out to lure you into taking more risk than is necessary to achieve their goals. The best way to reduce the risk of employer stock is through diversification. This doesn’t mean you can’t own any employer stock, but I have seen new clients with a net worth of $2 Million and $1.5 Million in employer stock, that’s clearly too much. A maximum limit that I would recommend my clients is to stay within is 10% of their liquid net worth. Still, that would be only if they have a high threshold for risk.

Below are a few RSU strategies you may be able to use based on the shares of employer stock you’ve accumulated. These are not recommendations, as I analyze and work with my clients in great depth to build more precise recommendations based on their personal scenarios.

Are you a tech employee in your 20’s or 30’s? I created a new podcast just for you. Techie Personal Finance Bootcamp

New RSUs

Low Expectations for RSUs

Do you expect the value of your company to perform better than the overall stock market (a diversified investment)? If not, then there is no reason to take more risk holding an undiversified investment that you expect underperform. Sell RSUs that vest as soon as allowable. Your shares are taxed at vesting. If you are able to sell them before any major price movements, there should be negligible tax consequences.

High Expectations for RSUs

Do you expect that your company will do amazing and outperform the overall stock market? Then you may be more inclined to hold on to your RSUs as they vest. This is a risky stance to take. You will want to review your exposure to your employer stock at least annually.

Unsure What to Expect about RSUs

Most people do not have strong feelings one way or another. Are comfortable holding the undiversified investment? Then you may want to decide on a sales strategy that gives you a portion of both worlds. Determine in advance, how much you will sell at vesting and how much you expect to sell in future years. Define this strategy and stick to it regardless of what stock is doing. This will give you some upside exposure and take some of the

Old Vested RSUs

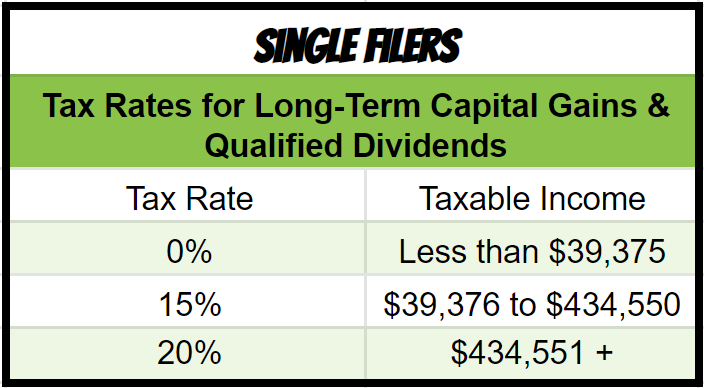

The market has been pretty hot across the board, so it’s likely that your accumulated employer stock has gone up in value. When your RSUs grow in value after they vested, they are taxed at capital gains rates. Depending on your threshold for paying taxes, you may be able to sell all or you may want to devise a systematic plan to gradually reduce your exposure to your employer’s stock.

(Charitably inclined?

Offset

You may also have some shares that have fallen in value while others have risen. You can use the shares with losses to offset the shares with gain from a tax perspective.

RSUs Tax Rate Arbitrage

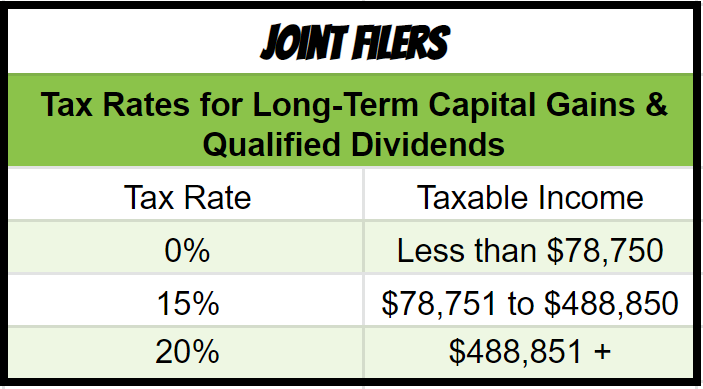

Capital gains tax is treated at a lower tax rate than where most people land for ordinary income tax brackets. There are three rates that apply to Capital Gains Tax, 0%, 15%, and 20%. However, there is also an additional Medicare surtax of 0.9% to be aware of. When your income tax bracket is higher than the capital gains tax, you may have a tax rate arbitrage.

Use the proceeds from the sale of your stock to defer income into one of the following:

- Traditional IRA

- Traditional 401(k)

- HSA

You will want to verify you’re eligible to make deductible contributions to these account types. You will also want to understand that funds added to them have their own unique set of rules. Mainly, withdrawal penalties if not used for retirement age 59.5 or older or health care in the case of the HSA. Due to withdrawal rules for retirement accounts, these are significantly more appealing as you are closer to retirement age.

Since there is the arbitrage effect, you do not need to move over all of the proceeds to offset

your taxes.

Much of your proceeds are not taxable because you already have a basis for paying taxes when you were first awarded your RSUs. You receive a bigger tax punch from the income deferral. Here are the current tax rates for RSUs when they vest as ordinary income.

Here are the current tax rates (2019) for old shares that you’ve accumulated when they become long-term gains.

Buy Put Options

If you are unable to sell all of your shares or simply don’t want to, you can buy put options on your employer stock to protect from catastrophic losses. Buying a put option gives you the right to sell your stock at an agreed upon amount before a particular date. This helps minimize the downside, but the cost of buying the put option reduces the upside by the cost paid.

Gifting to Family

Do you have a child that is old enough to not be taxed at Kiddie tax rates, but income low enough to avoid long-term capital gains rates? Instead of gifting funds to your children or family members via cash, consider transferring appreciate stock to them so they can liquidate with no capital gains tax. If those funds were going to be gifted to your child one way or another, then you just saved on your taxes.

Gifting to Charity

Gifting cash to charitable organizations is a horrible mistake if you have employer stock that has appreciated. Many organizations allow you to transfer the shares to their organization so that they can liquidate the stock tax-free. Want to super charge your charitable giving and possibly help navigate the new S.A.L.T (State and Local Tax caps)? Check out my post on Should I Use a Donor Advised Fund.

RSUs Summary

RSUs are an extremely valuable part of your overall compensation. If not managed as a part of a strategic plan RSUs can be extremely stressful to navigate. Establishing an RSU strategy will allow you to separate emotion from your decision-making process and allow you to make clearer decisions that align with your overall goals and risk tolerance.

You may also be interested in